Overview

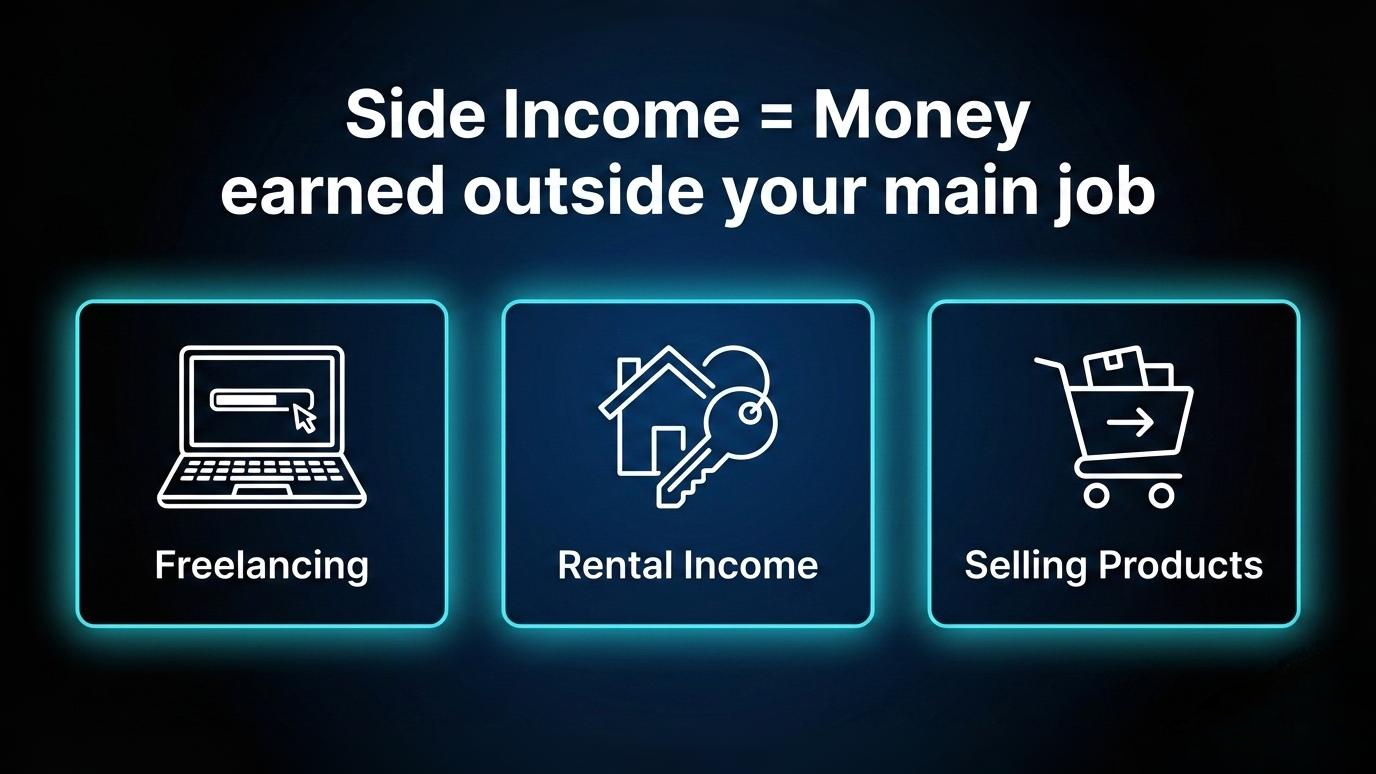

Side income is money you earn outside your primary job or main source of income. It's supplementary revenue from activities like freelancing, selling products, renting property, or investments. This income is taxable and must be reported to tax authorities. Anyone can earn side income—employees, self-employed professionals, or retirees—as long as they're generating money from secondary work or assets alongside their regular earnings.

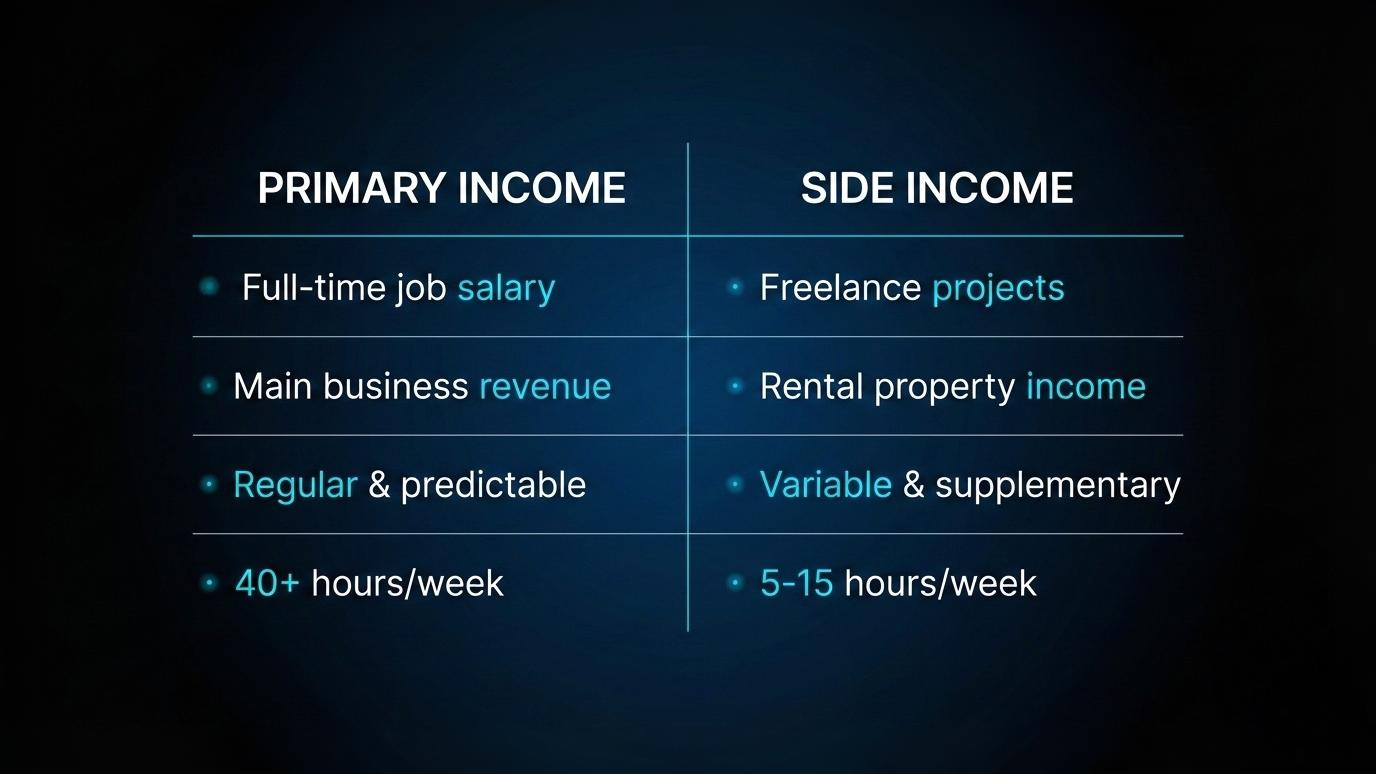

Understanding Side Income vs. Primary Income

Your primary income is the main, regular paycheck you rely on to cover living expenses. It typically comes from full-time employment or your core business.

Side income is different because it's earned from activities you do on the side. It's usually less predictable, requires less time commitment, and isn't your main financial support. However, the line can blur over time—what starts as side income can grow into your primary source if it becomes your main focus and revenue driver.

Because side income is often influenced by factors like demand fluctuations, platform dependence, and time availability, it can become unstable over time, especially if it isn’t actively managed.

In employment contexts, what is meant by side income often refers to "moonlighting" or holding a second job while maintaining your primary position.

When side income starts growing or turns into a business, many people also wonder—especially in India—whether legal registrations like GST are required, which depends on factors such as turnover, business model, and location.

Common Types of Side Income

Here are the most common ways people earn extra money:

- Freelance work or gig economy jobs – driving for rideshare services, graphic design, writing, or virtual assistance

- Rental income – leasing out property, a spare room, or equipment like cameras or tools

- Investment returns – dividends from stocks, interest from savings accounts, or capital gains

- Selling products – handmade crafts on Etsy, reselling items online, or running a small e-commerce store

- Part-time consulting or coaching – offering professional advice or teaching skills in your area of expertise

- Digital products or affiliate income – selling e-books, courses, or earning commissions by promoting other products

Each of these activities generates money outside your regular job, making them side income.

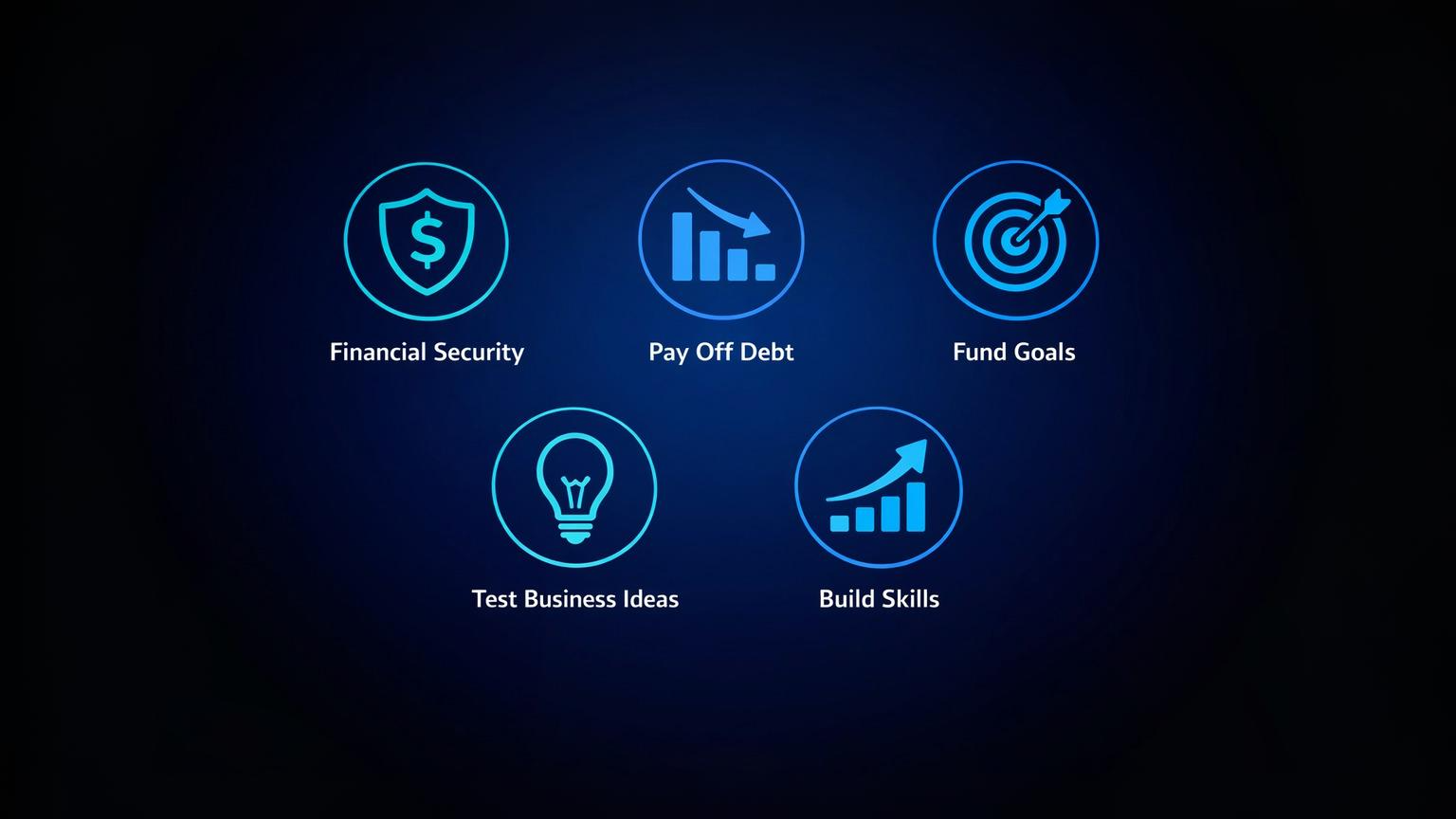

Why People Earn Side Income

People pursue side income for practical reasons:

-

Financial security – Building an emergency fund or creating a safety net against job loss or unexpected expenses.

-

Paying off debt faster – Using extra earnings to eliminate credit card balances, student loans, or mortgages more quickly.

-

Funding specific goals – Saving for a vacation, home renovation, child's education, or wedding without stretching the primary budget.

-

Testing business ideas – Experimenting with entrepreneurial ventures without the risk of quitting a stable job.

-

Building new skills – Learning and practicing expertise in a different field that might lead to career growth or pivots.

Side income offers flexibility and reduces financial pressure while keeping your main income stable.

What Counts as Side Income (and What Doesn't)

Most money you earn from secondary activities is side income and must be reported for taxes. This includes freelance fees, rental payments, product sales, and investment gains.

However, not everything counts. Gifts from friends or family are typically not taxable. Reimbursements for work expenses aren't income either—they're just returning money you already spent.

There's also a distinction between hobbies and businesses. If you occasionally sell handmade crafts at a loss for fun, that's a hobby. If you're consistently selling items for profit, it's side income from a business activity. Tax authorities care about this difference because business income has different reporting requirements.

You don't necessarily need to register a business immediately when you start earning side income, but you should track your earnings from the beginning.

Common Mistakes People Make About Side Income

Many people misunderstand how side income works:

Thinking it's tax-free – All side income is taxable once you earn above minimal thresholds. The tax authority expects you to report it.

Not tracking earnings properly – Failing to keep records of payments, invoices, and expenses makes tax filing difficult and can lead to penalties.

Confusing side income with passive income – Side income is a broad category that includes both active work (like freelancing) and passive streams (like rental income). Passive income is just one type of side income.

Assuming business registration is required immediately – While you should eventually formalize larger operations, many side income activities can start informally. Requirements vary by location and income level.

Overestimating time commitment – Some people avoid side income thinking it requires massive effort. In reality, many options fit into a few hours per week.

Understanding these distinctions helps you approach side income realistically and stay compliant.

Frequently Asked Questions (FAQ)

1. Is side income the same as passive income?

No. Side income is any money earned outside your primary source, whether it requires active work or not. Passive income is a subset of side income that generates money with minimal ongoing effort—like rental properties or dividend stocks.

2. Do I need to report side income on my taxes?

Yes, in most cases. Once your side income exceeds basic thresholds set by your tax authority, you must report it. Even small amounts should be tracked, as tax rules vary by location and income type.

3. Can side income replace my main job?

It's possible. Many people start with side income to test ideas or build skills, then transition it into their primary income once it becomes stable and profitable enough to support their lifestyle.

4. How much side income is normal?

There's no single "normal" amount. Side income varies widely—from a few hundred dollars monthly to several thousand—depending on the activity, time invested, and market demand. Focus on what works for your goals and schedule.

Key Takeaway

Side income is simply money you earn from secondary activities beyond your main job or business. Whether it's freelancing, renting assets, or selling products, these earnings supplement your primary income and provide financial flexibility.

The important thing is to track what you earn and report it properly. Side income can help you build savings, pay down debt, or explore new opportunities—all while keeping your main income source intact.

Published by URX Media, a platform focused on learning and explaining digital marketing, business and technology concepts through simple, accurate breakdowns.

📚Related Articles

Can I Do Online Business Without GST? (Explained for India)

Yes, you can do online business without GST in India, but only in specific situations. GST registration is not required if your annual turnover stays below the prescribed threshold, you do not make inter-state sales, and you’re not selling through most large marketplaces. This applies mainly to small sellers, freelancers, bloggers, and early-stage online businesses operating within one state.