Overview

Yes, side income can become unstable over time. Market demand shifts reduce opportunities, making it harder to secure consistent work. Platform changes affect gig workers through algorithm updates and policy revisions that cut reach and payouts. Client retention declines over time as budgets get reallocated or contracts end. Economic downturns impact spending, with side hustles often being the first expense businesses and individuals cut.

Before evaluating whether side income can remain stable in the long run, it helps to be clear about what side income actually means and how it differs from primary income sources.

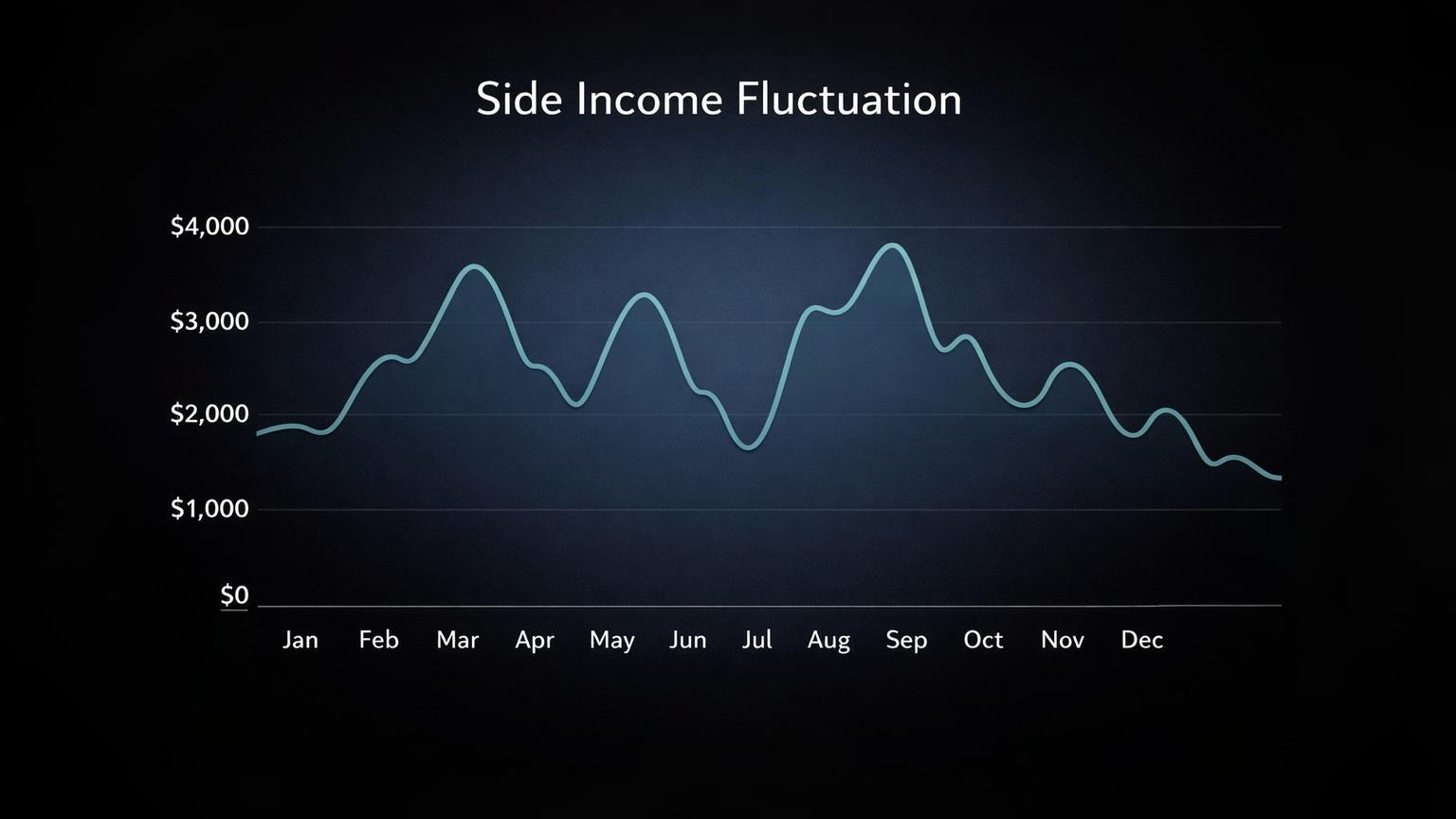

Digital side incomes—from freelance services to affiliate commissions—fluctuate unpredictably. Ad revenue streams can swing wildly based on seasonality and platform algorithm shifts. Most creators depend on just a few platforms, so any policy update or algorithm change can immediately impact earnings. Without proactive management, side income built on external platforms remains vulnerable to sudden volatility.

Why Side Income Becomes Unstable

Market saturation increases competition as more people enter low-barrier niches like blogging, templates, and gig platforms. When supply exceeds demand, rates fall and discoverability drops. Standing out requires continuous effort in SEO, marketing, and unique positioning to avoid downward pressure on prices.

Algorithm changes reduce visibility when platforms shift content priorities. Social media and search algorithms reward certain patterns, and when these change—like prioritizing Reels over feed posts—creators suddenly see fewer views and clicks. Those drops translate directly into lower affiliate sales and ad revenue. Overreliance on one platform's algorithmic distribution creates unstable traffic and income.

Seasonal fluctuations affect demand in predictable ways. Some niches experience natural ebbs and flows—tax services peak in spring, travel content surges in summer. These feast-or-famine cycles can catch you off-guard if you're not tracking patterns. Watching your analytics for sudden traffic changes helps signal these cyclical effects early.

Client budgets get cut first during economic uncertainty. When companies tighten spending, freelancers and side contractors are easier to eliminate than full-time employees. This makes side income inherently less protected than traditional employment, especially during downturns.

Early Warning Signs of Instability

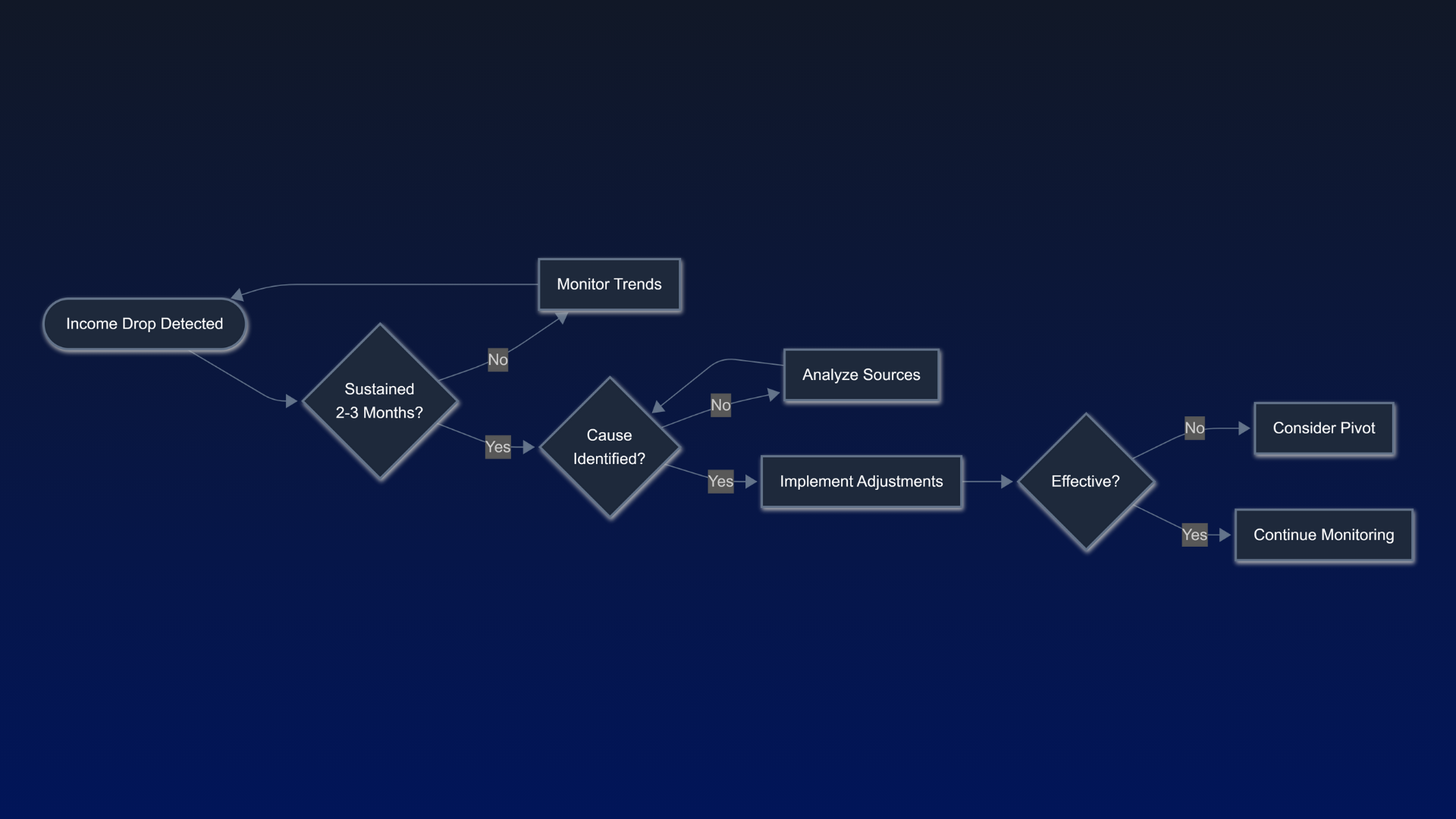

Declining monthly earnings trend is the clearest signal. When you notice consistent drops over 2-3 months without changes in your effort or workload, something's wrong. This revenue volatility indicates your current channel or strategy is exhausted or facing new competition.

Fewer repeat customers suggest your service or content isn't creating lasting value. If clients or customers aren't coming back, you're constantly chasing new business—which costs more time and money than retention. Track your repeat rate monthly to spot this trend early.

Payment delays increase when clients face their own financial pressure. Late invoices or requests to extend payment terms often precede contract cancellations. If multiple clients start delaying payments simultaneously, it signals broader market issues.

Platform policy changes can reshape your income overnight. YouTube raising watch-time thresholds, TikTok phasing out creator funds, or Upwork increasing fees—these updates often come with little warning. If you feel constant stress about platform changes, you're too exposed to a single source.

Increased time for same revenue means diminishing returns. When your hours double but earnings barely budge, that time-to-income mismatch is a warning. You're working harder for less, which isn't sustainable long-term.

Factors That Accelerate Instability

Single income stream dependency is the biggest risk factor. If one client accounts for most of your freelance work, losing them is devastating. Similarly, relying entirely on one platform means any policy change can wipe out your income. Analysts consistently warn against putting all your income in one basket.

No pricing adjustments made over time means you're losing ground to inflation and market changes. If you haven't raised rates in a year or more, you're effectively earning less. Regular pricing reviews—at least annually—help maintain income stability.

Skills become outdated in fast-moving digital fields. What worked two years ago may be obsolete today. Continuous learning and adaptation keep you competitive. If you're seeing fewer opportunities, assess whether your skills match current market demand.

Platform-only presence leaves you vulnerable. If your entire audience lives on Instagram or YouTube and you have no email list or owned website, you're at the platform's mercy. One account suspension could end your income stream immediately.

No client relationships built means you're always starting from scratch. If you treat every project as transactional, you miss opportunities for repeat work and referrals. Cultivating direct relationships with clients and audience members provides stability that platform algorithms can't touch.

How to Spot Instability Before Crisis

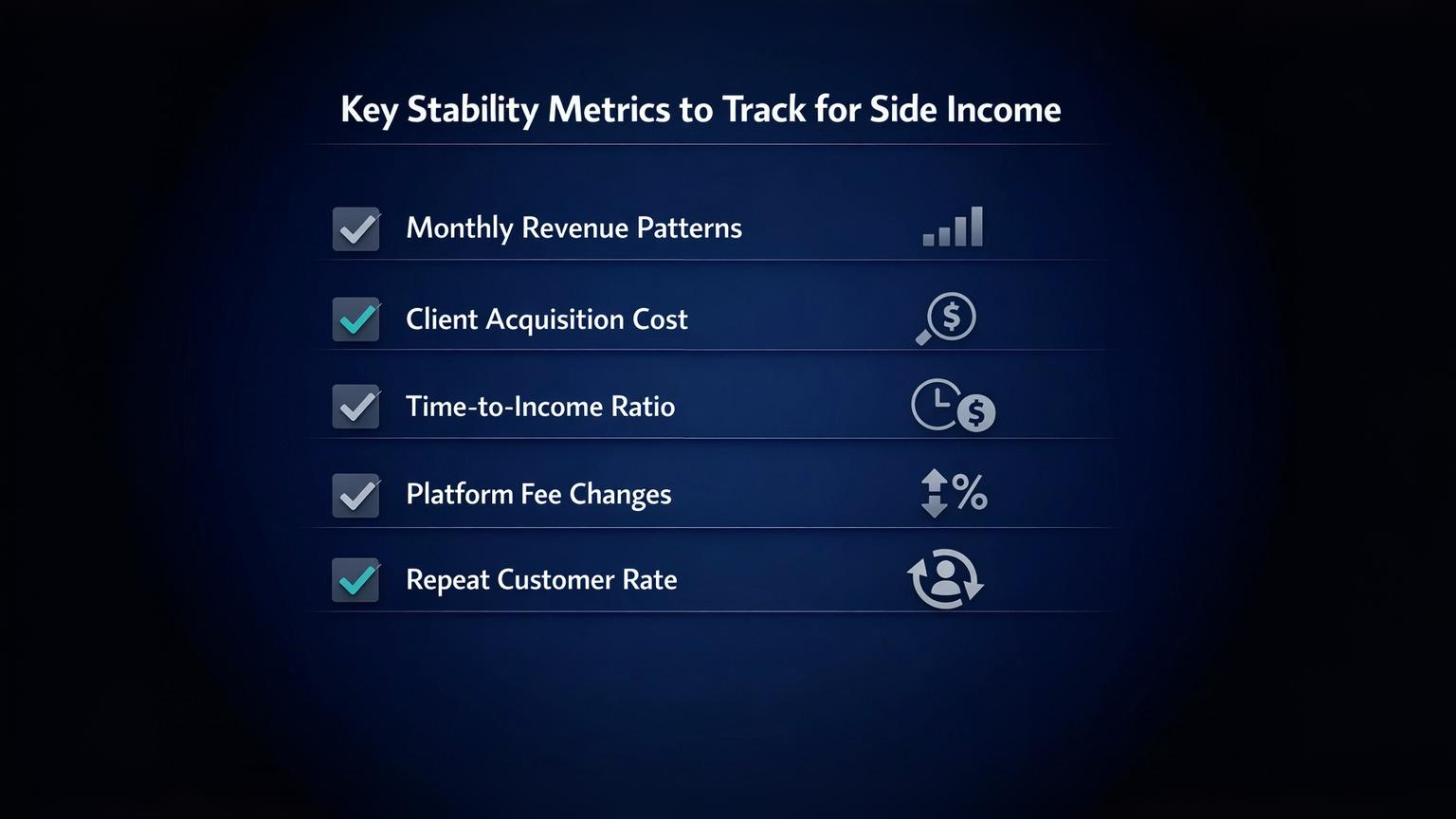

Track monthly revenue patterns in a simple spreadsheet. Record income from each source, hours worked, and conversion rates. This data reveals trends before they become crises—like a disappearing client or flatlining blog traffic.

Monitor client acquisition cost by tracking how much time and money you spend getting new business. If this cost is rising while project values stay flat, your business model is under stress. Healthy side income should maintain or improve efficiency over time.

Measure time-to-income ratio weekly or monthly. Calculate how many hours you worked versus what you earned. If this ratio worsens consistently, you're heading toward burnout or unsustainability. Adjust your strategy before it becomes critical.

Check platform fee changes and policy updates regularly. Join creator or freelancer communities where news spreads fast. The sooner you detect a fee hike or algorithm shift, the faster you can adapt your content or outreach to compensate.

Stabilization Strategies

Diversify across platforms to reduce single-point risk. Don't rely solely on YouTube—also build on podcasts, newsletters, or TikTok. For freelancers, maintain clients across different industries or platforms. A common strategy is the portfolio approach: one high-touch service for steady cash, one scalable product, and one passive channel.

Build email list ownership so you control your audience connection. Unlike social platforms, an email list can't be taken away by algorithm changes. Move audience members toward contact you own—your website, newsletter, or community. This buys stability when platform reach shrinks.

Create recurring revenue streams through memberships, retainers, or subscription products. Aim for at least 20-30% of revenue to come from predictable monthly sources. This cushions the impact when one-off projects dry up temporarily.

Develop multiple skill sets relevant to your field. If you're a writer, add editing or content strategy. If you're a designer, learn basic coding or video editing. Versatility opens more opportunities and protects against demand shifts in any single service.

Maintain emergency fund equal to 2-3 months of typical expenses. This financial buffer lets you decline low-pay gigs without panic and prevents a single dry spell from leading to debt. Save a percentage of every payment automatically—aim for 25-30% toward taxes and another 10-15% toward emergency savings.

Common Mistakes / Warnings

Ignoring early revenue decline signals leads to bigger problems. Many people rationalize one bad month as a fluke, then another, until the trend becomes undeniable. Address drops immediately by investigating causes and adjusting strategy.

Over-reliance on single platform makes you vulnerable to sudden changes. Even if one platform is your strongest channel, build presence elsewhere. Platform dependence is like having just one client—it's too risky.

Not tracking income patterns means you're flying blind. Without data, you can't distinguish between normal variation and genuine decline. Set up basic tracking from day one, even if it's just a simple spreadsheet.

Failing to save during high months creates problems during low ones. It's tempting to increase spending when income spikes, but side income volatility requires conservative money management. Base your budget on your lowest-earning month, not your best.

Assuming stability equals permanence is dangerous thinking. Just because your side income has been steady for six months doesn't mean it will stay that way. Platforms change, markets shift, and competition increases. Stay alert and adaptable.

Not diversifying client base concentrates risk unnecessarily. A healthy rule is that no single client should exceed 20-30% of total revenue. Spread work across multiple clients so one cancellation doesn't derail your finances.

FAQ Section

1. How quickly can side income become unstable?

Side income can destabilize within weeks if tied to a single platform or client. Algorithm changes or policy updates can cut reach overnight. More gradual instability develops over 3-6 months as market saturation or client budget cuts accumulate. Regular monitoring helps you spot trouble before it becomes critical.

2. What percentage drop signals instability?

A 20-30% decline in monthly income over 2-3 consecutive months signals instability worth investigating. Single-month drops can be normal variation, but sustained decreases indicate structural issues. Track both total income and income per hour worked—if either drops consistently, adjust your strategy.

3. Can stable side income suddenly fail?

Yes, especially with platform-dependent income. Account suspensions, algorithm changes, or policy updates can eliminate revenue streams with no warning. Client-dependent income is also vulnerable—one major client leaving can cut earnings by half instantly. This is why diversification matters more than current stability.

4. Should I quit if income becomes unstable?

Not immediately. First, identify the cause—is it temporary seasonality, a fixable problem, or fundamental decline? Try adjustments like diversifying platforms, raising rates, or improving service quality. If instability persists after 3-6 months of effort and you can't achieve consistent minimums, consider pivoting to a different side income or focusing on your primary job.

5. How many income streams prevent instability?

Three to five distinct streams provide meaningful protection without excessive complexity. This might include: two freelance clients, one digital product, one affiliate channel, and one ad-based platform. Each stream should operate independently—different platforms, clients, or revenue models—so one failure doesn't cascade to others.

Final Summary

Side income instability is common, driven by platform changes, market saturation, and client dynamics. Early detection prevents major loss—tracking revenue patterns, client acquisition costs, and time-to-income ratios reveals problems before they become crises.

Diversification reduces risk more than any single strategy. Multiple clients, platforms, and revenue types insulate you from sudden changes. Regular monitoring is essential for catching trends early and adapting quickly.

Adaptation maintains stability in changing markets. What works today may not work next year, so continuous learning and flexibility keep your side income viable. Treat volatility as normal, build financial buffers, and maintain multiple income channels to weather inevitable fluctuations.

Published by URX Media, a platform focused on learning and explaining digital marketing, business and technology concepts through simple, accurate breakdowns.

📚Related Articles

Can I Do Online Business Without GST? (Explained for India)

Yes, you can do online business without GST in India, but only in specific situations. GST registration is not required if your annual turnover stays below the prescribed threshold, you do not make inter-state sales, and you’re not selling through most large marketplaces. This applies mainly to small sellers, freelancers, bloggers, and early-stage online businesses operating within one state.