Overview

Yes, you can do online business without GST in India, but only in specific situations. GST registration is not required if your annual turnover stays below the prescribed threshold, you do not make inter-state sales, and you’re not selling through most large marketplaces. This applies mainly to small sellers, freelancers, bloggers, and early-stage online businesses operating within one state.

However, GST becomes mandatory once you cross the turnover limit, start inter-state supplies, or sell through certain e-commerce platforms. The requirement depends on how you earn online, not just how much you earn.

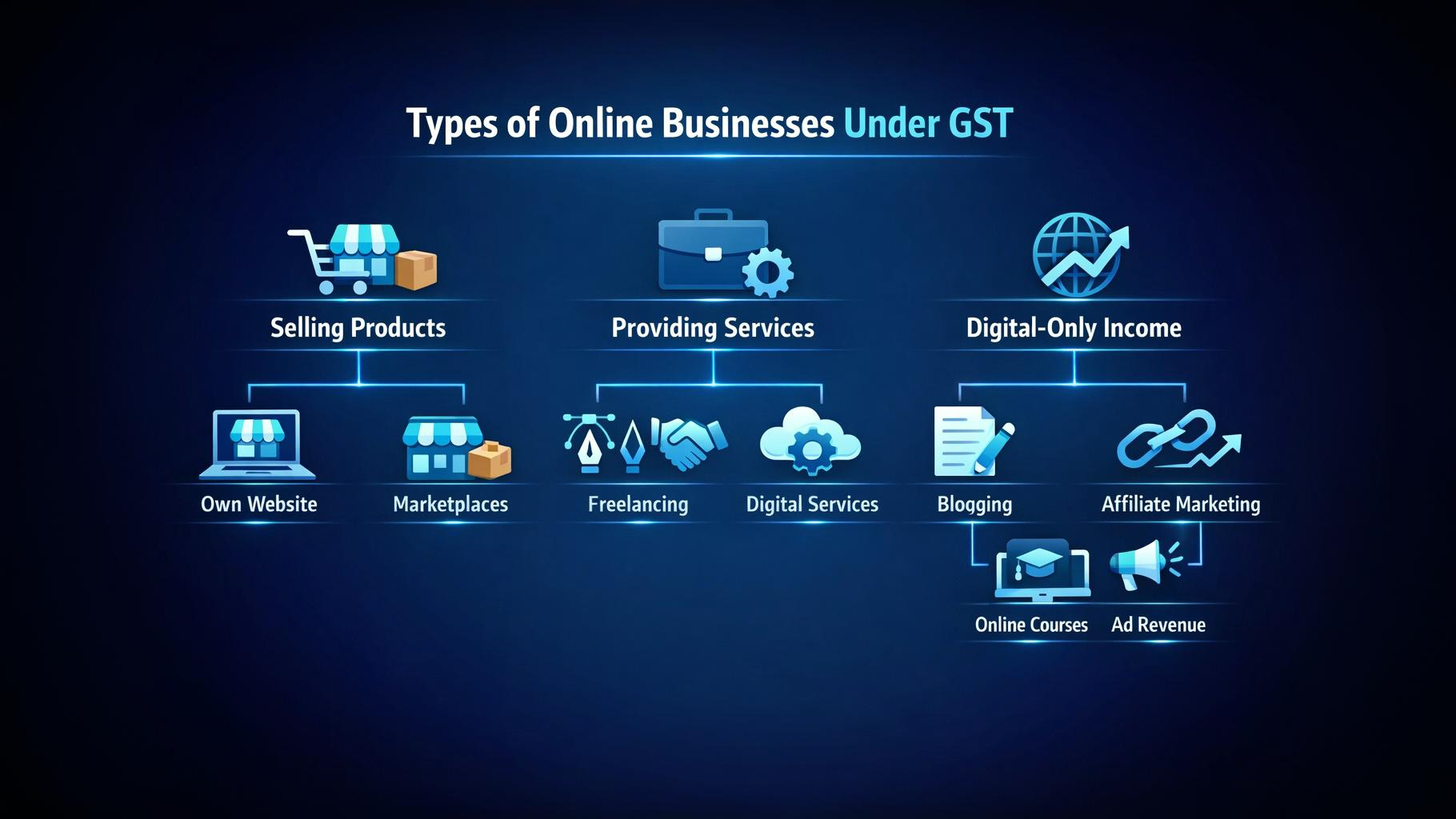

What counts as an “online business” under GST

An online business is any activity where you earn money using the internet as the primary channel. Under GST, the business model matters more than the medium.

Common categories include:

- Selling products

- Through your own website

- Through marketplaces like Amazon, Flipkart, or Meesho

- Providing services

- Freelancing (design, development, consulting)

- Digital services (SaaS tools, subscriptions)

- Digital-only income

- Blogging, affiliate marketing

- Online courses, ad revenue

GST law looks at:

- Whether you’re selling goods or services

- Whether sales are within one state or across states

- Whether a marketplace is involved

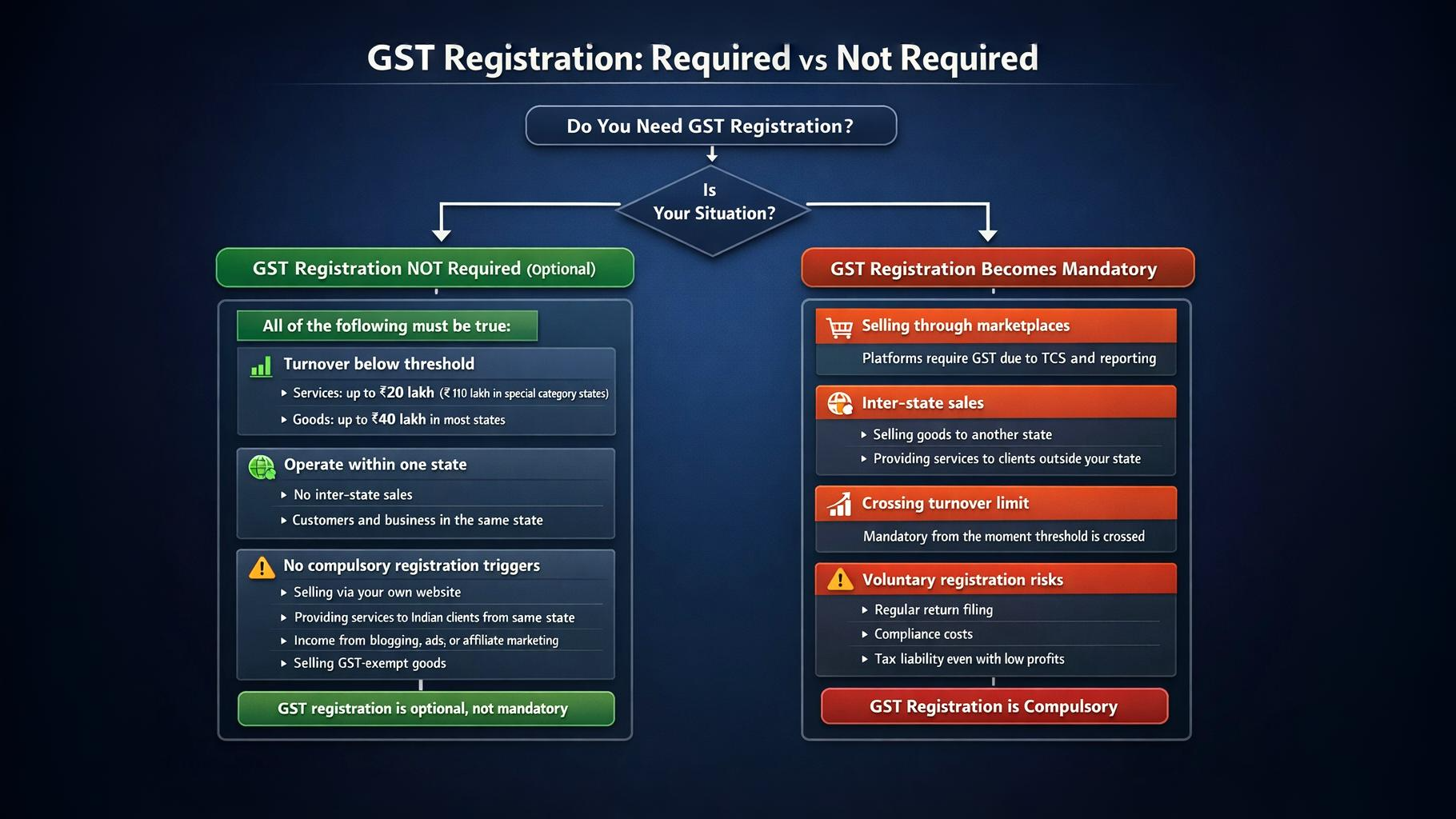

Situations where GST registration is NOT required

You don’t need GST registration if all of the following conditions are met.

Your turnover is below the threshold

- For services: up to ₹20 lakh per year (₹10 lakh in special category states)

- For goods: up to ₹40 lakh per year in most states

You operate within one state

- No inter-state sales

- Customers and business location are in the same state

You are not required to register compulsorily. This typically applies when:

- You sell through your own website

- You offer services to Indian clients from the same state

- You earn from blogging, ads, or affiliate income

- You sell GST-exempt goods

In these cases, GST registration is optional, not mandatory.

Situations where GST registration becomes mandatory

GST becomes compulsory the moment you fall into any of these situations.

Selling through marketplaces Most major platforms require sellers to have GST registration because they collect tax at source and report seller data.

Inter-state sales

- Selling goods to customers in another state

- Providing services to clients located outside your state

Crossing the turnover limit Once your turnover crosses the threshold, registration becomes mandatory from that point onward.

As online income grows and business conditions change, earnings that start as small and predictable can fluctuate significantly, making long-term consistency harder to maintain. This is why side income that scales without planning can become unstable over time.

Voluntary registration risks Registering early may seem safe, but it triggers:

- Regular return filing

- Compliance costs

- Tax liability even if profits are low

Payment and platform realities Payment gateways don’t require GST by default, but many marketplaces and ad platforms may ask for it once scale increases.

Practical examples (real-world scenarios)

Blogger earning ad revenue

A blogger earning ₹8 lakh a year from ads, operating from one state, does not need GST registration.

Freelancer serving Indian clients

A freelance designer earning ₹15 lakh from clients within the same state can operate without GST.

Small seller using own website

A handmade product seller earning ₹12 lakh annually through their own site, shipping within one state, does not need GST.

Same seller joining Amazon or Flipkart

The moment the seller joins a major marketplace, GST registration typically becomes mandatory, even if turnover is low.

Common mistakes or warnings

Assuming low income always means no GST

Certain activities trigger compulsory registration regardless of income.

Registering too early

Early registration increases compliance without clear benefits for small operators.

Confusing income tax with GST

Income tax applies to profit; GST applies to turnover.

Ignoring platform-specific rules

Each marketplace has its own onboarding and compliance requirements.

Frequently Asked Questions (FAQ)

1. Can I start an online business first and take GST later?

Yes. You can start without GST and register later once it becomes mandatory.

2. Is GST required for freelancing or digital services?

Not if your turnover is below the threshold and services are provided within one state.

3. Does using a payment gateway require GST?

No. Payment gateways don’t require GST registration by default.

4. What happens if I cross the GST threshold later?

You must register for GST once the limit is crossed and comply from that point onward.

5. Is GST required for blogging or affiliate income?

No, as long as your turnover is below the threshold and no compulsory conditions apply.

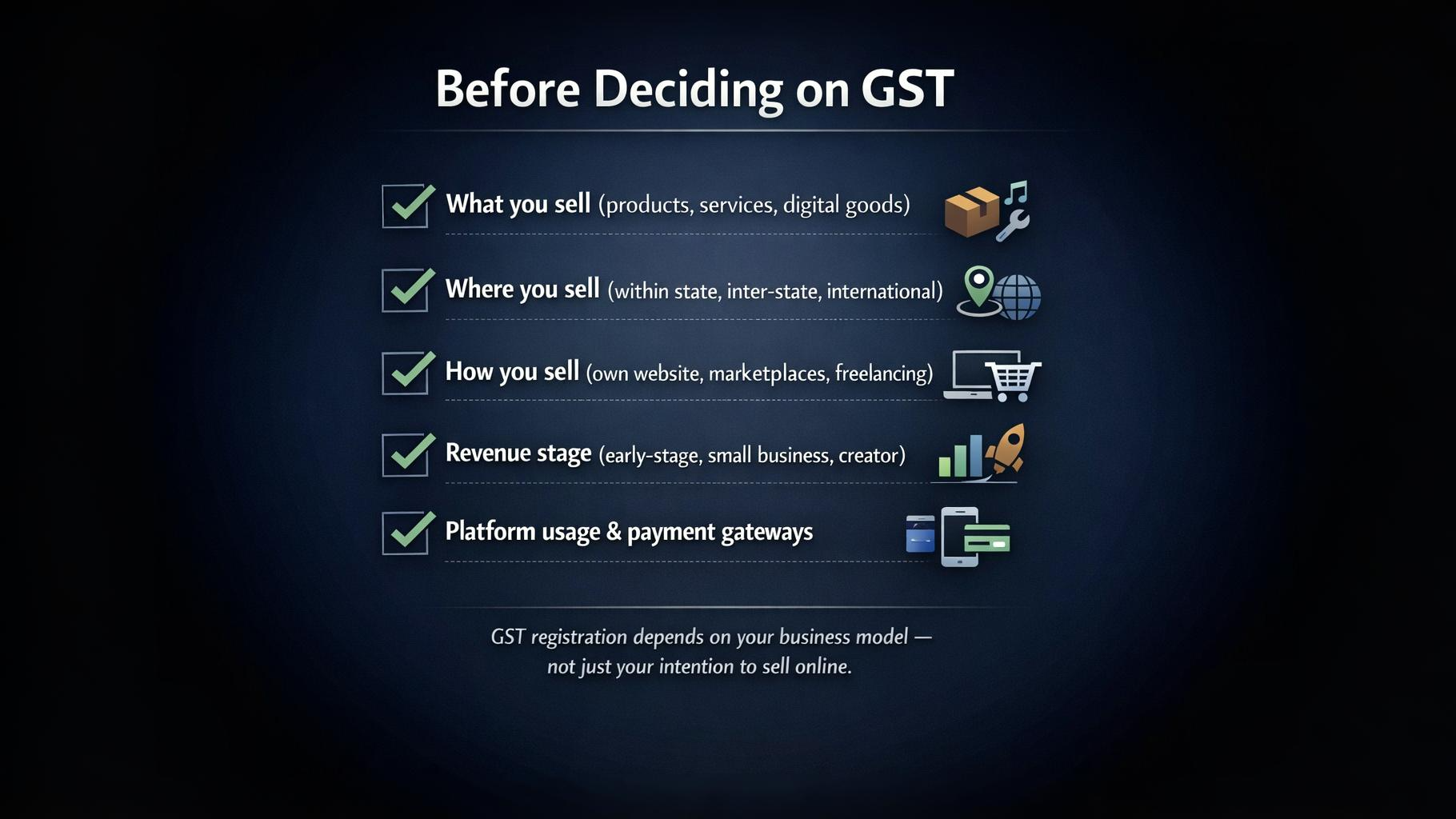

Final Summary

Doing online business in India without GST is legally possible—but only when your business model allows it. The requirement depends on what you sell, where you sell, and how you sell. Small online businesses, freelancers, and creators can often operate without GST in the early stages.

Before registering, always map your revenue source, customer location, and platform usage. A clear understanding upfront can save time, money, and compliance stress later.

Published by URX Media, a platform focused on learning and explaining digital marketing, business and technology concepts through simple, accurate breakdowns.